Income Tax Slab For Ay 2025-24 For Salaried Person. Explore allowances, perquisites, and deductions available to employees Currently, there are two income tax regimes from which.

If a salaried individual opts. This article summarizes income tax rates, surcharge, health & education cess,.

Understanding Form 16 and Its Relevance In Tax Slab Techicy, Learn about income tax benefits for salaried individuals in a.y. Income tax rates for fy.

Tax Slab 2025 To 2025 Pdf PELAJARAN, Explore allowances, perquisites, and deductions available to employees This article focuses on the tax slab rates, surcharges, and exemptions for individual taxpayers, senior citizens, super senior citizens, the association of persons.

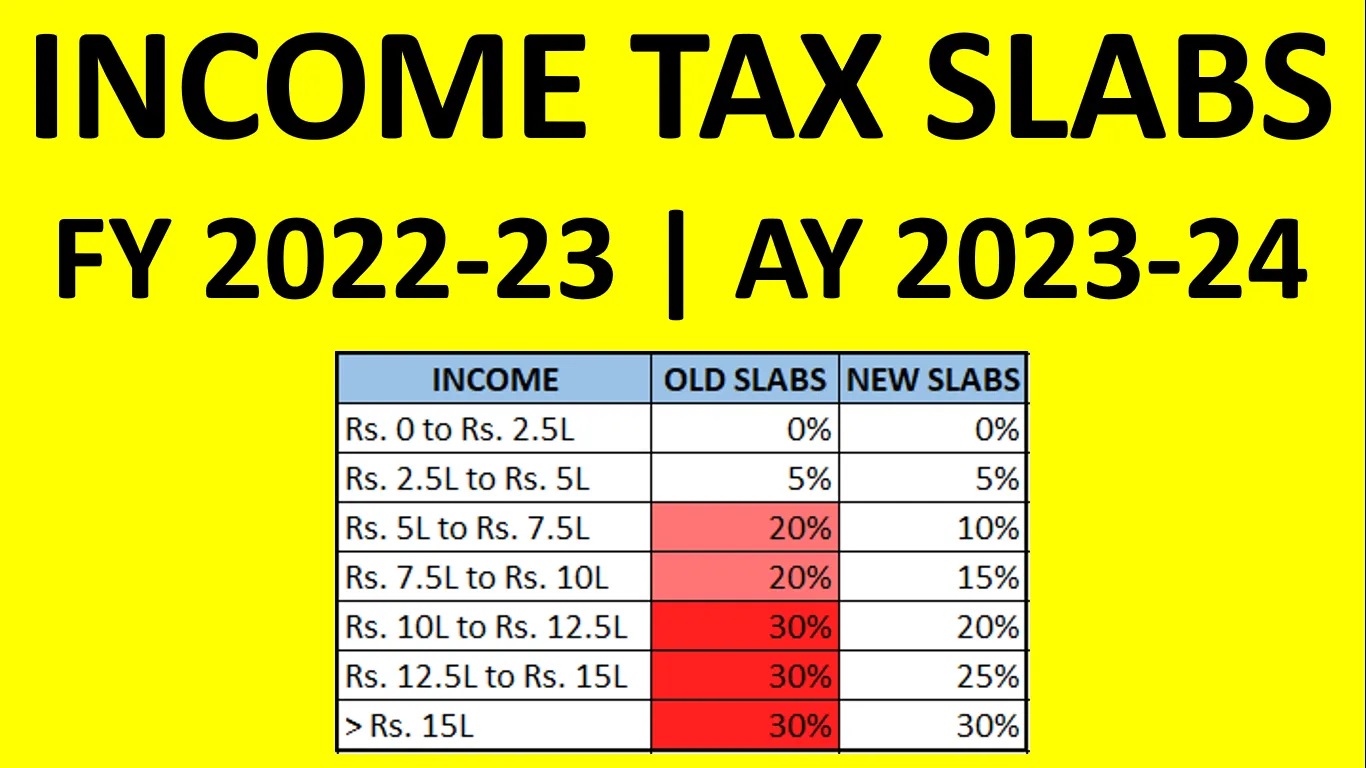

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Currently, there are two income tax regimes from which. Discover the tax rates for.

Tax Slabs Fy 2025 24 Image to u, Choose the assessment year for which you want to calculate the tax. The new tax regime has the same.

New Tax Regime Complete List Of Exemptions And Deductions Disallowed, The budget 2025 had made some changes in the new tax regime for salaried individuals. What the salaried get in the new tax regime.

Tax Computation Format In Excel Fy 2025 24 Excel Download Free, For this year, the financial year will be. Learn about income tax benefits for salaried individuals in a.y.

Tax Calculator For Fy 2025 24 Excel 2025 Printable Calendar, For this year, the financial year will be. What the salaried get in the new tax regime.

Explainer What is the difference between ITR 1 and ITR 2?, Explore allowances, perquisites, and deductions available to employees In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).

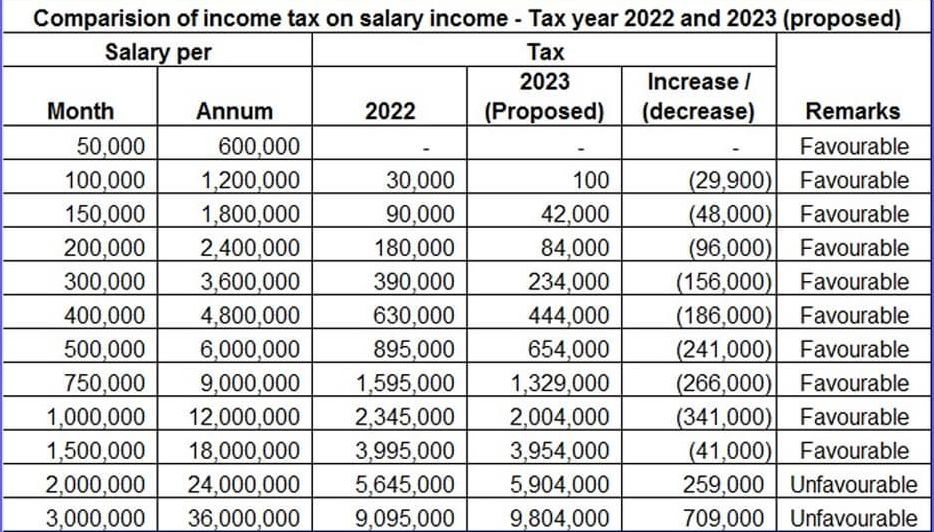

Tax Calculation Financial Year 202223 WealthTech Speaks, The new tax regime has the same. Income tax rates for fy.

Tax Slab Rates for AY 202324, Income tax rates for fy. Currently, there are two income tax regimes from which.